Carbon Credit Procurement Primer | Chapter 2: Forward Contracts

Securing future credits at guaranteed prices

Carbon Credits

Jan 18, 2024

Siya Kulkarni

Last week, in the first of our Carbon Credit Procurement Primer series, we dove into the world of spot market purchases of carbon credits and their applications. This week, we continue with Chapter 2, exploring forward contracts, and how they might compare to spots or offtakes in their impact and risk.

Quick Recap: What is a credit, and what are the three ways to procure it?

Previously, we covered the basics of carbon credits, highlighting the important differences between avoidance and removal credits, their applications, and the mechanisms available to procure credits in the voluntary markets. We noted that removal credits are valuable for organisations’ long-term decarbonisation plans, and can be procured in three ways: spot market purchases, forward contracts, or multi-year offtake agreements.

We focused on spot market purchases, which are transactions for already issued credits from primary or secondary markets at current prices. While the risk of delivery of these credits is low, spot purchases come with several other drawbacks, namely, limited availability of issued credits, price inflation, and inability to implement long-term positive impact at scale.

Enter the forward agreement: an agreement between a buyer and seller of carbon credits for a specified volume of credits at a guaranteed price at a future date.

Back to the Future: What is a forward contract in the context of carbon credits?

A forward contract allows buyers to purchase credits in the future at an established price. The carbon credits purchased in a forward agreement are ex-ante credits. This means that they have not been delivered or issued yet, and will be delivered in the future. Forward contracts therefore rely on an estimated carbon curve estimated by the project developer, predicting how much carbon may be sequestered over the project’s lifetime.

Forward contracts are becoming increasingly more popular than spot purchases among large organisations seeking to address their emissions as they enable long-term planning. Forwards are also a commonly used tool among carbon traders for hedging purposes.

These contracts may vary in the way a transaction or delivery of credits is carried out. For example, a forward contract may specify a volume of credits to be delivered on a certain date or may specify a proportion of credits issued from a project on a certain date. Credits issued may be from a single project, or a portfolio of projects from which a specified number of credits may be delivered.

Why are forward contracts a good option for you?

One of the main goals of a forward contract is to address price inflation - the risk of a carbon credit being priced much higher in the future. Carbon markets have grown tremendously over the recent years, and demand for removal credits specifically has skyrocketed, with CDR.fyi data showing that credit sales volumes reached 5.3 million tonnes in December 2023, from 130,000 tonnes in December 2021. This means forward contracts can also help organisations with budgeting and planning for their decarbonisation plans. Buyers are guaranteed a price when they enter a contract, allowing them to strategise their purchase decisions.

In addition to price security, forward contracts have the advantage of choice and variety. Unlike spot market purchases, which rely on the availability of credits in the market today, forward contracts give organisations the flexibility to explore credits issued from ongoing projects, or projects in pre-development stages, that may better fit the buyers’ mandates or values. Several carbon removal projects are currently in the nascent stages of development and are highly innovative in their design. Forward agreements can help organisations access these novel projects at favourable prices.

Finally, forward agreements allow buyers to deliver impact at a far greater scale compared to spot market purchases. Many of these early-stage projects require some level of commitment from a buyer for a certain volume of credits to commence or continue developing the project - forward contracts can help support these projects on this front, while also benefiting buyers looking for opportunities for impact that go beyond the purchase and retirement of credits, and helping with the development or expansion of some projects.

An attractive option, but not not the optimal solution

Forward contracts have many advantages that make them an attractive solution for companies from a strategic and impact perspective. However, they are not perfect and can be risky in several ways.

For one, forward contracts, unlike spots, come with a great deal of delivery risk as they are contracts for the future delivery of carbon credits. As these credits have not yet been issued - and therefore, the carbon in question has not been sequestered - buyers that enter into forward agreements do so knowing that the credits may not be issued in the future.

Nature-based carbon removal projects are subject to several risks such as climate change impacts, or administrative delays, that may prevent their timely development or credit delivery. Projects must be designed with scientific rigour, community involvement, and frequent monitoring for transparency and accountability. Additionally, carbon curves must account for a buffer pool, which provides a more conservative estimate of carbon sequestration due to the potential for plant mortality or other physical risks along the project's lifetime.

Forward contracts can also place a buyer at risk of price inflation - it is possible that based on market conditions and the quality of the project, the buyer may have entered into a contract at a higher price than the prevailing spot market rate at the time of delivery.

Finally, while they offer opportunities for greater impact than spot purchases, forward agreements are also one-time purchases of credits that offer limited impact, versus offtake agreements, which are multi-year purchases that allow for a greater level of engagement and relationship management with the project developers.

The Takeaway

Forward credits are useful tools for strategic planning and implementation, and provide buyers with the opportunity to explore credits from new and developing projects. However, they are not without drawbacks and must be assessed from the perspective of maximising impact.

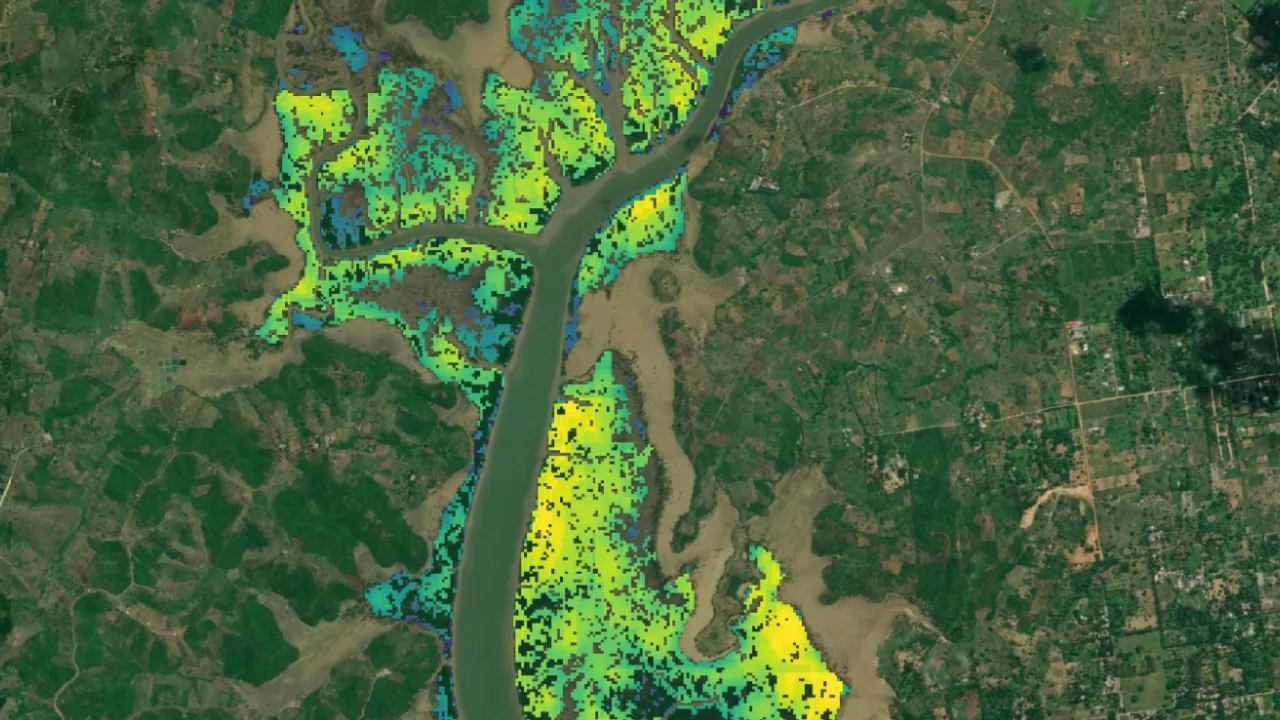

It is very important to note that delivery risk can be mitigated with strong project design elements. This includes factors that increase the durability of a carbon project, such as knowledge of specific institutional or legal safeguards, as well as community engagement participation to incentivise the effective management of the project. Project design must also ensure transparency and good data availability on carbon stocking. This is achieved through regular monitoring through satellite and drone data, to establish appropriate baselines and measure carbon stock changes over the project lifecycle.

Here at Treeconomy, we offer several solutions to help mitigate risks associated with forward purchase agreements. When you acquire carbon credits through our marketplace, you gain access to the highest quality carbon removal credits, all backed by our pioneering digital monitoring technology and science. We provide valuable, reportable data to help you understand and analyse the impact of your carbon investments. The projects you support with your purchases have a number of co-benefits in addition to carbon removals, including biodiversity enhancement and local livelihood generation.

Hear from one of our spot purchase customers

“Zopeful Climate is excited to be exploring collaboration with Treeconomy. In a nature-based carbon market in much-needed transformation, we like their approach to rigorous project set-up diligence, MRV, and new monitoring tech, as well as staying as close to the project developer as possible. We believe that this is in line with creating higher quality nature-based carbon projects with genuine impact, restoring trust and providing greater transparency for buyers.” - Adam Oskwarek

–

Ready to purchase carbon credits with us? Explore our pipeline of projects by visiting Treeconomy’s marketplace here or contact us at hello@treeconomy.co.

Stay tuned for our third and final chapter on carbon credit procurement methods, where we explore the world of offtake agreements!