Carbon Credit Procurement Primer | Chapter 3: Offtake Agreements

Delivering long-term impact at scale

Carbon Credits

Feb 14, 2024

Siya Kulkarni

This is the third and final part of our series on the three main carbon credit procurement methods and their merits and drawbacks. We’ve previously gone through spot market purchases and forward contracts. In this blog, we go through what is fast becoming the most popular means for buyers to procure credits: multi-year offtake agreements. What are offtakes, why are they gaining traction, and why are they beneficial for large-scale impact? Read on to find out.

A recap on spots and forwards

Carbon credit procurement has become a costly business in recent years. As we’ve discussed in previous posts, carbon removal credits - which represent the removal of a tonne of CO2 out of the atmosphere - are extremely valuable to organisations’ decarbonisation strategies.

Many of these credits are traded in the voluntary carbon market, and organisations can purchase already-issued (ex-post) credits, or sign agreements to purchase credits that are yet to be delivered (ex-ante) at a specified price in the future. However, these methods may not be optimal in delivering impact or providing financial visibility. Spot market purchases provide certainty in a credit’s delivery but come with the risk of price inflation as well as limited impact and availability. Forward contracts offer organisations more options but are also one-time purchases that don’t necessarily enable large-scale impact.

Is there a solution that maximises flexibility and scalability?

Enter the multi-year offtake agreement.

Offtakes, being multi-year, long-term contracts for a continuous purchase of credits over a given period, allow for greater visibility and involvement of the buyer in the project development process, and in turn, support the buyer in their claims for long-term and sustained positive environmental and social impact via these projects.

Offtakes also help with better relationship building with project developers and can give way to the continuation and expansion of project development and credit issuance at a much larger scale than a one-time forward agreement, and can mobilise larger quantities of financing for future projects.

Essentially, such agreements help buyers to engage with the project ground-up, by partnering with a project developer at a relatively early stage of development to purchase a specified amount of credits issued over multiple years. This benefits not only the buyer but also the developer, as it helps with maintaining a project over a longer period and ensuring the durability of the project. Long-term projects can be scaled up and are likely to crowd in further investment, multiplying the effects of an initial offtake agreement, and ultimately, contributing to the deepening of the voluntary carbon removal market.

And of course, for the buyer itself, offtake agreements help with financial planning. The cost of carbon offsetting, particularly for nature-based projects, is rising rapidly and is expected to increase sharply by 2030 as a result of supply and demand dynamics. Estimates by PwC show that carbon offsetting costs for FTSE 350 companies could rise by as much as 256% by 2030 to £135m, from £38m in 2022. Establishing a reliable stream of high-quality credits at a favourable price point allows for financial stability and predictability.

Similar to forward purchase agreements, buyers can lock in an inflation-linked price point for credits to be delivered in the future, protecting them from large fluctuations in spot pricing and allowing them to address their future decarbonisation needs over multiple years. Buyers can also enter into innovative purchasing strategies, including agreements to purchase credits from a portfolio of diversified projects, that can be customised to suit specific duration and carbon removal needs.

Are long-term offtakes suitable for you?

Like any purchase reliant on the future delivery of a product, carbon offtake agreements subject buyers to a certain level of risk. As with forward contracts, ex-ante carbon credits pose delivery risks to buyers, particularly amid a rise in physical climate impacts, as well as changing and improving methodologies.

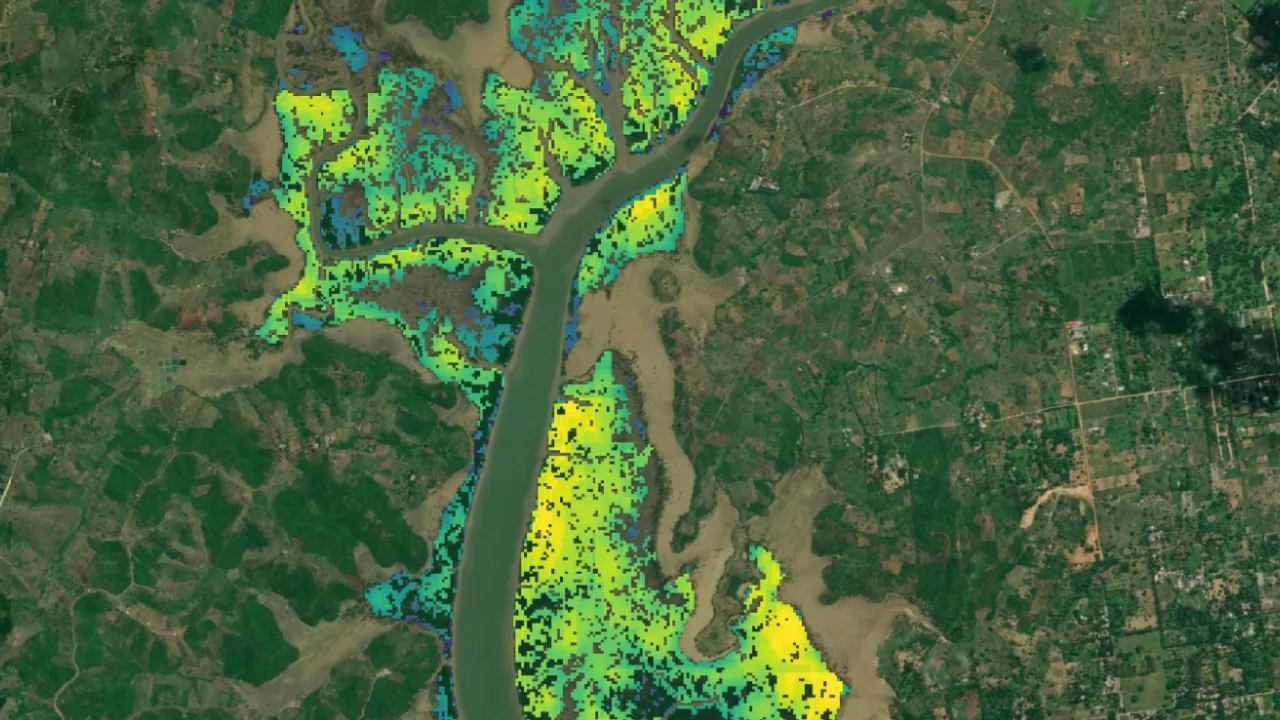

To mitigate these risks, buyers must implement some measures to ensure that they are investing at the intersection of high quality and high impact. This means ensuring that carbon projects are protected by administrative and institutional safeguards including legal protections, local community involvement and benefit sharing, and insurance. Additionally, the use of monitoring technology to deliver frequent, reportable data on baseline emissions and carbon stock changes over time can generate trust and ensure that project interventions are impactful and additional.

Carbon offtake agreements for high-quality projects in particular require large commitments over multiple years (usually 10 - 15 years). Accrued over that time scale, such agreements are costly, with investment ticket sizes running into the millions of dollars. It is no surprise that many large corporations are entering into long-term offtake agreements as a part of their climate strategies. Offtake agreements are therefore limiting for small-scale buyers which may not have the same capacity to finance long-term purchase agreements.

The Takeaway

Carbon offtake agreements are thus far the most impactful and effective means to deliver long-term impact in a cost-efficient manner for organisations. However, they mostly cater to larger organisations with greater funding capacity and require buyers to implement thorough risk management measures.

This marks the end of our three-part series on carbon credit procurement methods. Each of the three - spot purchases, forwards, and offtakes - has some advantages and disadvantages that need to be considered before making a purchase decision.

Here at Treeconomy, we offer a number of solutions for buyers based on their needs and capacity. Our marketplace provides many key information points on our global pipeline of monitored projects, that can help you make an optimal decision on a purchase that addresses your decarbonisation needs. If you are interested in the purchase of long-term offtakes, we are also happy to provide tailored solutions with our project portfolio.

—

Ready to purchase carbon credits with us? Explore our pipeline of projects by visiting Treeconomy’s marketplace here or contact us at hello@treeconomy.co.