Risk Series I | Geography and carbon

Why location matters for nature-based carbon projects

Carbon Credits

May 3, 2024

Siya Kulkarni

Assessing risks is an essential step that buyers, sellers, and financiers of carbon projects must undertake, especially in the case of nature-based projects. To do so, it is important to note that this means identifying and mapping risks across the entire lifecycle of the project, starting from its conception to planting and management, and even after its completion.

As a dedicated solutions provider, our mission is to bring high-quality credits to buyers. We are actively involved in de-risking projects, ensuring quality, integrity, and lasting impact. This is why we are starting a Risk Series designed to equip buyers with the most crucial considerations before they make purchase decisions - risks impacting a project's carbon yield and meaningful risk management and mitigation tools.

Amid a constantly evolving carbon policy landscape, increasing severe weather events from climate change, and uncertainties around local institutional safeguards, geography is one of the first points of screening for buyers of carbon credits. This first Risk blog explores the various geographical and location-specific risks that buyers encounter, and options for mitigation.

Treeconomy identifies risks that emerge from a project's location as sources of geographical risk. These risks could be at the local, regional, or national level. Geographical risks could potentially also extend to the risks faced by project stakeholders, including buyers, based on their location and their relationship with the project.

Below, we break down the different risks related to the geography of the project:

1. Physical risks

One of the first questions that buyers ask about a project is, where is it located?

For nature-based carbon removal, the country and region where the project intervention activities are intended to take place are important considerations. For example, is the project located in an area of high exposure to physical climate change-related impacts? How likely and severe is the risk of fire, flooding, or other natural disasters to the project? And how suitable is the project area for the planned project interventions?

In 2021, wildfires destroyed 9.3 million hectares of forests and will become increasingly severe each year. Other climate change impacts that could disrupt forest productivity and health include the spread of disease and pests, floods, droughts, and extreme temperatures (heat and frost). The likelihood and severity of these risks differ from project to project.

Physical risks can impact a project both during and after the project's lifetime. Physical risks such as natural disasters can result in the invalidation of credits within an estimated carbon curve if they impact the project during the management period. These risks can also result in reversals - when carbon that has been absorbed from the atmosphere is released again - after the project is completed. One of the key criteria for a high-quality project is durability - so, high reversal risk is not desirable for carbon buyers who seek lasting impact after the project’s crediting period and lifetime.

2. Policy and regulatory risks

In addition to physical risks that impact the project, buyers must also consider the risks of the policy landscape and regulatory changes that could help or hinder the project. Policies can range from specific national or regional environmental or carbon market regulations that the project and its proponents must adhere to wider movements in carbon markets via standard setters, independent auditors, and regulators.

Governments of countries with a high potential for nature restoration are growing increasingly wary of project developers implementing exploitative practices. As a result, many have implemented their own internal rules and regulations to monitor and approve projects. For example, the Indonesian government requires projects to obtain approval from the Ministry of Environment and Forestry ahead of commencement. Due to oversight, two REDD+ projects faced cancellations in 2022 over claims that they did not comply with Indonesian law.

Another significant trend in carbon regulation is rules around revenue sharing and taxation for carbon projects. Last year, the government of Zimbabwe set a precedent by mandating that developers can keep 70% of carbon revenue proceeds in return for 30% going to the government for the first 10 years of a project. Countries including Kenya and Malawi have followed suit, proposing revenue-sharing agreements to ensure that the financial benefits of carbon projects also reach the country.

Such measures can impact project pricing and costs as well as timelines for project implementation. Regulatory shocks could invalidate credits or create reversal and even lead to price fluctuations and the project’s reputational damage.

3. Political and socioeconomic risks

Carbon project buyers must also ensure that at the project level, communities that are directly or indirectly impacted by the project have been engaged in a fair and transparent manner. A rule of thumb is to ensure that Free, Prior, and Informed Consent (FPIC) has been obtained from the communities and that any marginalised or vulnerable groups have been identified. Additionally, it must be ensured that there are no culturally or socially significant areas in which the projects are being developed. Finally, at a broader level, buyers must also be aware of any risk of political instability that could disrupt the project.

Reputational risks to projects from political or social issues can have severe consequences for carbon project buyers that have entered into long-term contracts, as reversals and losses from these issues can disrupt their decarbonisation strategy and lead to tremendous financial losses.

Community involvement in a project is not only a responsible project practice but also ensures the longevity of the project and reduces reversal risk. This is particularly helpful for carbon credit buyers. A project that incentivises communities to manage and maintain restored forests with suitable sustainable livelihood opportunities and benefit sharing from carbon revenue is likely to last longer and have a greater positive social and environmental impact, while also delivering the requisite removals for buyers.

Risk management and mitigation techniques

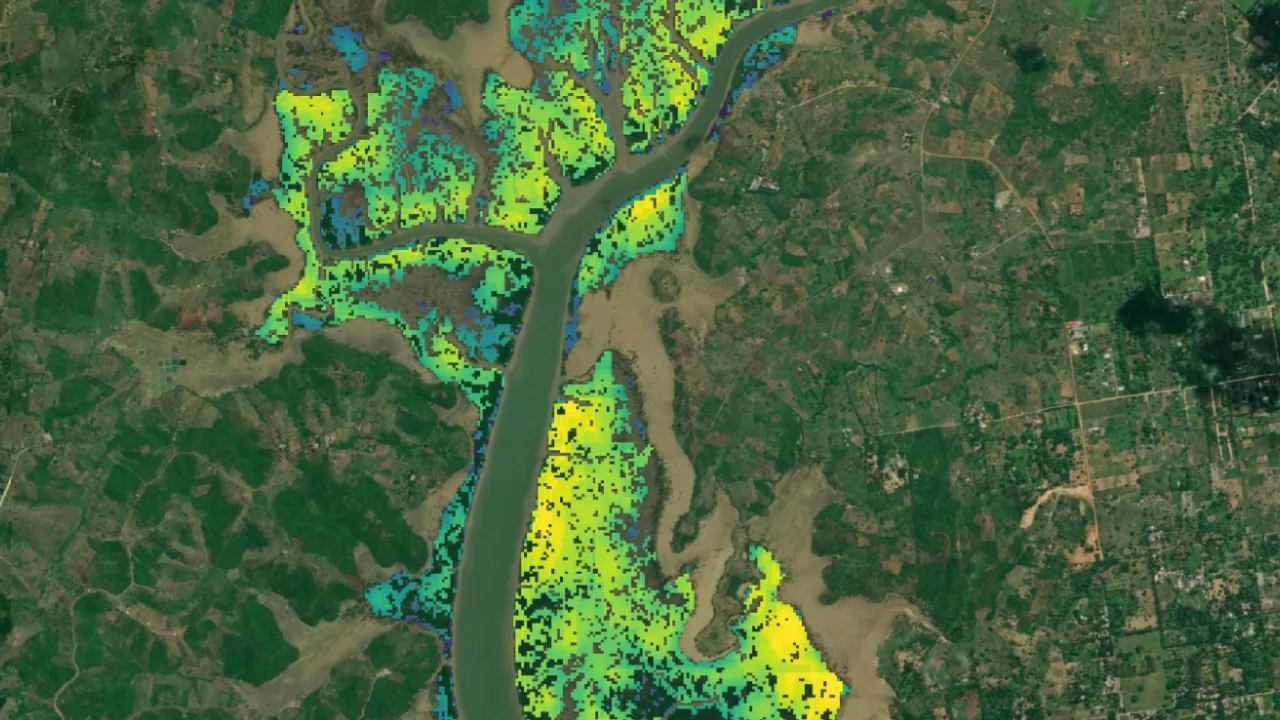

- Monitoring, reporting, and verification (MRV): MRV is a vital risk management tool that reassures buyers with transparency. Frequent monitoring and reporting on project metrics including carbon emissions and removals, disturbances, and risk events can allow buyers to assess and respond to any risks to the delivery of their purchased credits. At Treeconomy, we work directly with the de-risking of projects via digital MRV and remote sensing of carbon removals. Efficient, scientifically rigorous assessments of project areas ensure that the true impact of project interventions is being measured, protecting buyers from reputational risk.

- Insurance: Risk management for physical risks that result in unintentional reversals and invalidation includes providing carbon insurance for the buyer, to ensure that they receive either monetary compensation or replacement credits for lost credits. Insurance is also a suitable measure to protect buyers from invalidation as a result of regulatory shocks.

- Project development methods: Risk mitigation measures against physical risks include creating firebreaks if a project is exposed to wildfire risk. Planting durable, native species encourages biodiversity and promotes a healthy, resilient ecosystem, making it more resistant to natural disasters and disease.

How Treeconomy can help

Here at Treeconomy, we strive to bring buyers some of the highest-quality carbon projects that are de-risked with Treeconomy’s proprietary monitoring technology, project financing at an early stage, and experienced, on-ground developers with deep knowledge of local and regional dynamics in the project jurisdiction.

Ready to purchase premium credits? Visit our marketplace to learn more, or contact us at hello@treeconomy.co.