Risk Series III: Operational Risks

Considering ongoing operational issues that projects might face

Carbon Credits

Jun 20, 2024

Siya Kulkarni

As carbon markets grow, evolve, and face ups and downs, it is important to understand that carbon projects have never been risk-free. However, these risks must not deter buyers from engaging with carbon markets. On the contrary, knowing the sources of risks and ways to mitigate them can help unlock valuable carbon financing for projects that boost global climate action and produce lasting social and environmental benefits.

In previous blogs, we have covered geographical and commercial risks to carbon projects that buyers need to address before they enter into agreements.

To recap, geographical risks are those related to the location of a project. The jurisdictional risks arising from local rules and regulations, political instability, and physical threats to natural capital projects are some of the main issues that could impede the successful delivery of carbon credits. Meanwhile, commercial risks are related to the financial viability of a project. Early-stage projects, in particular, need to secure seed capital to get them off the ground, and all projects experience price volatility on an ongoing basis.

In this third and final blog on carbon project risks, we look at some of the other ongoing operational issues that projects might face.

Types of operational risks

1. Management and governance

Buyers looking into potential carbon projects must take into account developers' capacity to deliver on the project outcomes. While it is not a guarantee of quality, looking into management experience in relevant fields—ecology, finance, and country-level experience—can help reassure buyers that the project has been designed to a high standard.

Strong governance must also support the project. This requires knowledgeable developers and representation across decision-making and leadership roles. Natural capital projects that impact local communities must demonstrate partnerships and support for these communities, as well as clear responsibilities shared with local partners.

Poor governance would not only impact the delivery of credits but could also create reputational issues that buyers would want to avoid when purchasing credits.

2. Fraud and negligence

In a complex market where standards are still under development, the potential for issues stemming from fraudulent activities or negligence can be high. Fraud and negligence can result in credits being invalidated, hindering carbon strategies and leading to financial setbacks for multi-year offtake buyers. Fraud could be both internal and external - sellers could potentially inflate credits or double-count them when selling to buyers, or the project could be exposed to hacking or phishing scams directed at carbon registries. External fraud is an unavoidable risk, while internal cases of fraud can be mitigated with checks and balances in place over the project's lifetime.

3. Insolvency or abandonment

A project may be terminated or abandoned prematurely due to the insolvency of the developer or investors for a variety of reasons. This could be due to the unavailability of adequate financing to progress the project or regulatory mandates to terminate the project in certain jurisdictions. Additionally, the project could also be hindered by insolvency or a change in standards used to back it. Buyers relying on multi-year contracts for carbon supply must be wary of these risks impeding their long-term carbon management strategies.

Risk mitigation methods

While the buyer cannot mitigate all the above risks, measures can be taken to reassure the buyer that the project is likely to be successful in the long term.

Ensuring strong governance and management capacity is one of the first checks that buyers must undertake. Long-term offtake buyers who can engage with developers at an early stage of the project development process can benefit from relationships built with the developers over the project lifetime and have a say in the project activities. Developing a strong understanding of local rules and regulations and ensuring that projects are compliant with them to the best of their ability also alleviates the risk of premature termination and reputational issues.

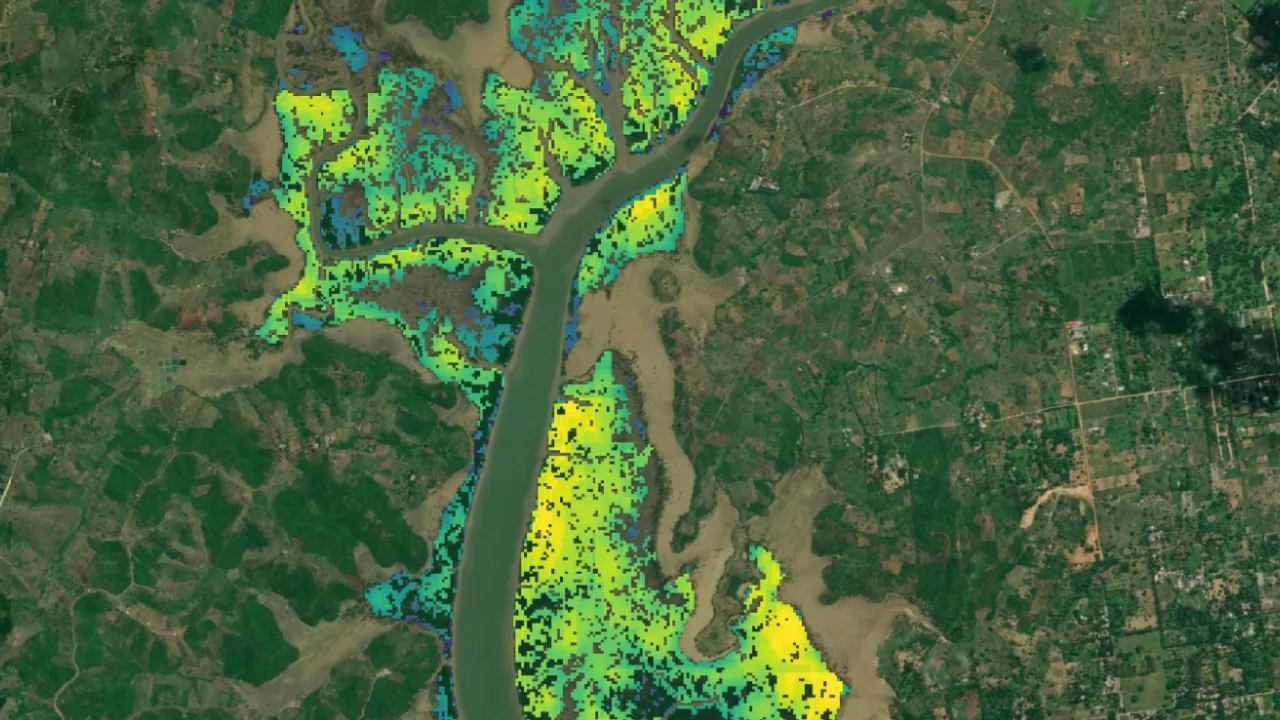

While fraud and negligence may not always be avoided, buyers can ensure that the methodologies used for projects are robust and verifiable. Regular external audits and monitoring can also keep the project development process in check. This does not only include audits on the ground—remote sensing over the project lifetime can help efficiently and objectively evaluate the quality of a project over its lifetime.

As a final measure to protect oneself from the outcomes of these risks, buyers can purchase insurance policies tailored to the specific risks that they face over the project lifetime. A number of policies exist to address financial and carbon losses to buyers and investors, including like-for-like carbon credit payouts.

How Treeconomy can help

Treeconomy strives to deliver best-in-class, de-risked carbon removal credits to buyers. To learn more about our curated nature-based carbon removal project pipeline and how we help de-risk our projects, reach out to us at hello@treeconomy.co.