SBTi and The Importance of Quality Carbon Markets

What the SBTi announcements mean for carbon markets

Carbon Credits

Project Development

Science & Tech

Aug 1, 2024

Siya Kulkarni

On Tuesday, the Science-Based Targets initiative (SBTi) released a series of hotly-anticipated publications on Scope 3 emissions, with one of the key focus areas being the effectiveness of carbon credits to achieve climate targets.

One of the underlying pieces of research was a call for evidence on carbon credits (reduction and avoidance) to address climate targets, the results of which were inconclusive.

Separately, the organisation prepared a discussion paper exploring potential scenarios for the use of environmental attribute certificates - which include carbon credits - in tackling value chain emissions. The paper presented five scenarios for the use of these certificates to substantiate net zero claims, along with risks associated with each:

- Commodity certificates from value chain activities, whereby buyers can demonstrate that the commodities they source are consistent with global emissions goals

- High-quality, high-impact commodity certificates where value chain traceability is low, demonstrating alliance with climate targets

- Carbon credits issued from within the value chain for insetting, using appropriate accounting methods to ensure fungibility with GHG inventory

- Carbon credits for permanent removals to neutralise residual emissions

- High-quality carbon credits for Beyond Value Chain Mitigation (BVCM) to incentivise companies to take action on unabated emissions

Our takeaways

The main recommendations regarding the use of credits provided by the SBTi across all three scenarios address issues related to traceability, risk management, and setting quality criteria and standards to ensure integrity.

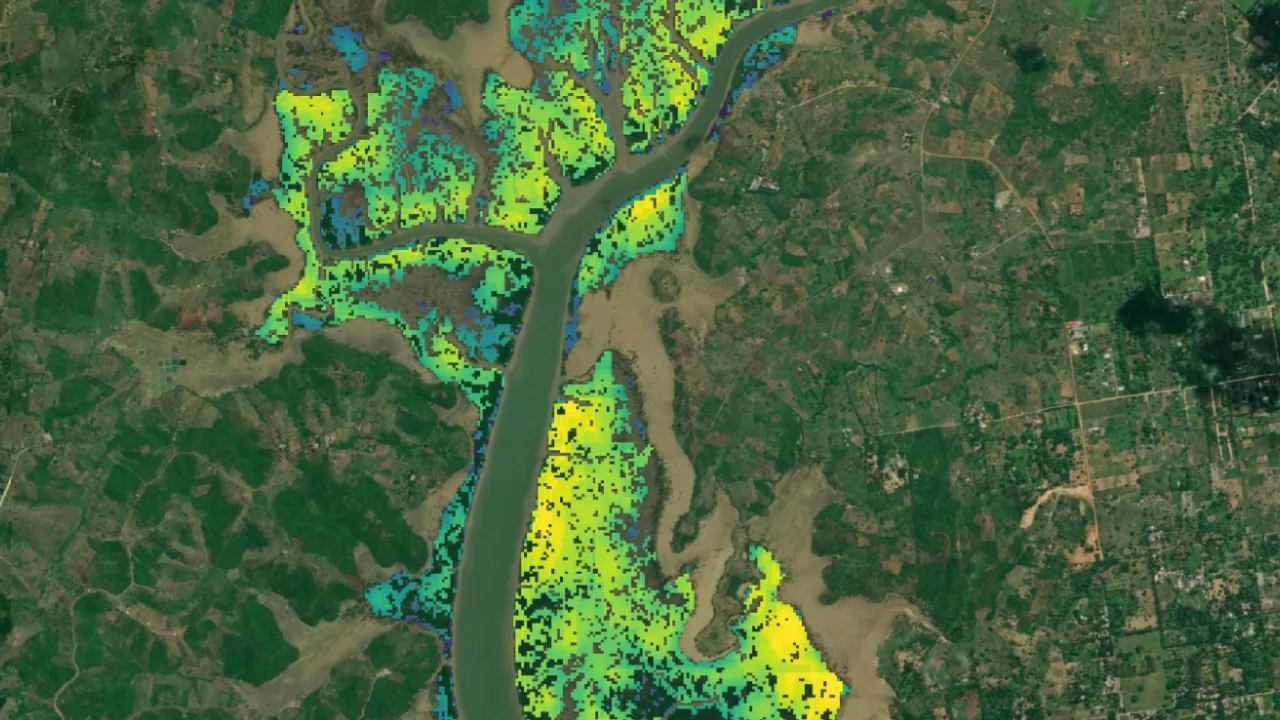

While the SBTi has been cautious in its approach to addressing the role and importance of carbon credits in corporate climate strategy, it is important to note that the carbon market- particularly nature-based carbon removal - is critical in providing benefits that extend beyond mitigation targets.

According to the State of Finance for Nature Report 2023, current capital flows towards nature-based solutions stand at $200 billion, which is a third of what is required. In contrast, nature-negative finance flows stand at $7 trillion annually. The annual investment needs for nature restoration are estimated at $125 billion per year in 2025 are expected to increase to $177 billion a year by 2030 due to ongoing nature loss and degradation.

The world simply cannot meet these targets without the support of a deep, thriving carbon market.

At Treeconomy, we hope that the SBTi aligns its guidance to address the increasing need for high-quality carbon removal solutions that are additional, durable, de-risked, and empower societies and communities over the long term.

Nature-based carbon removal cannot be scaled without financial incentives in the form of carbon credits, which can both support investments and bring much-needed capital flows towards communities and countries in need of transition finance.

As we’ve discussed in previous blogs, the need for carbon markets is immediate and necessary to scale nature restoration in the long term while also supporting near-term corporate climate targets, as the path to decarbonisation is complex and costly.

To explore our high-quality, de-risked projects that support community-driven nature-based carbon removal projects, visit our Marketplace or reach out to us at hello@treeconomy.co.